New Delhi: Bengaluru-headquartered iD Fresh Food, known for its packaged ready-to-cook breakfast staples such as dosa and idli batter, is in talks with Carlyle, Kedaara, ChrysCap, Multiples, Verlinvest and other private equity firms to raise about ₹1,200 crore, people aware of the development said.

The size of the funding round could be shrunk further as existing investors plan to sell only a small portion of their holdings and the company has a limited need for fresh funds, the sources told ET.As an alternative strategy, HNI clients of 360 One Wealth and family offices have also been approached as they could be willing to write smaller cheques, they said.

Small Portion for Sale

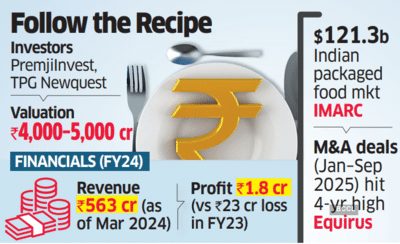

Founded by techie-turned-entrepreneur Musthafa Cheriammed Pathayickode in 2005, iD Fresh Food’s existing backers are PremjiInvest and TPG Newquest. “Existing investors only want to sell a small portion,” a person privy to the development said. “The fundraise could push out the company’s IPO plans by a few years,” he added.

The valuation of the company is being pegged at between ₹4,000-5,000 crore, people cited above said.

Billionaire Azim Premji's family office PremjiInvest had bought a stake – estimated between 25-30% – in the company in 2017. TPG Newquest's stake could not be ascertained.

iD Fresh Food is said to have grown revenues by 40-50% in the past two years and is close to clocking ₹1,000 crore in annual sales.

Carlyle declined to comment. Kedaara, ChrysCap, Multiples and Verlinvest did not respond to queries as of press time Thursday.

An email seeking comments from Musthafa, who also officiates as the company’s global CEO, too, remained unanswered.

DIFFERENTIATED MODEL

“Investors see high potential in the company, given its differentiated model of fresh batters and ready-to-cook portfolio. This has escalated at a time when consumers are seeking preservative-free options,” an executive aware of the developments told ET.

“The negotiations on valuations, however, are being based on increasing hyper-local competitors and whether iD Fresh has the ability to scale nationally while sustaining its core business model of daily fresh supplies,” the person added.

iD Fresh Food differentiates itself from other branded breakfast batter makers, such as MTR Foods and Gits, by delivering fresh and un-stored batter fermented daily, leading to retailers placing orders daily instead of the usual fortnightly or monthly cycles.

A majority of the firm’s sales are done on quick-commerce and ecommerce channels. Its portfolio has expanded to parathas, paneer, curd and coffee now.

iD Fresh Food reported its first profits in the year ended March 2024, at ₹1.8 crore on a revenue of ₹563 crore. It has previously spoken of its ambition to expand presence in countries with a large Indian diaspora such as Singapore, the US, UK and West Asia.

DEALS PICK UP

Investment banker Equirus Capital in a report released on Thursday said the country’s consumer space saw 115 M&A deals in the January-September 2025 period, the highest in four years. The number is already higher than 100 deals reported in the whole of calendar 2022.

“Food and beverages, followed by apparel and accessories, witnessed the highest percentage of deals in Jan-Sept '25,” the report said.

In value terms, the consumer segment saw deals worth more than ₹21,200 crore in the first nine months, with 74% of the deals in the food and beverages segment, it said.

IMARC Group estimates the Indian packaged food market to clock sales of $224.8 billion by 2033, growing at a CAGR of 6.5% between 2025 and 2033. According to the research firm, the market reported total sales of $121.3 billion in 2024. It attributed the growth to rapid urbanisation, changing lifestyles, increasing disposable incomes, rising demand for convenience foods, and consumer preferences for ready-to-eat meals, in addition to growth in online food delivery.

The size of the funding round could be shrunk further as existing investors plan to sell only a small portion of their holdings and the company has a limited need for fresh funds, the sources told ET.As an alternative strategy, HNI clients of 360 One Wealth and family offices have also been approached as they could be willing to write smaller cheques, they said.

Small Portion for Sale

Founded by techie-turned-entrepreneur Musthafa Cheriammed Pathayickode in 2005, iD Fresh Food’s existing backers are PremjiInvest and TPG Newquest. “Existing investors only want to sell a small portion,” a person privy to the development said. “The fundraise could push out the company’s IPO plans by a few years,” he added.

The valuation of the company is being pegged at between ₹4,000-5,000 crore, people cited above said.

Billionaire Azim Premji's family office PremjiInvest had bought a stake – estimated between 25-30% – in the company in 2017. TPG Newquest's stake could not be ascertained.

iD Fresh Food is said to have grown revenues by 40-50% in the past two years and is close to clocking ₹1,000 crore in annual sales.

Carlyle declined to comment. Kedaara, ChrysCap, Multiples and Verlinvest did not respond to queries as of press time Thursday.

An email seeking comments from Musthafa, who also officiates as the company’s global CEO, too, remained unanswered.

DIFFERENTIATED MODEL

“Investors see high potential in the company, given its differentiated model of fresh batters and ready-to-cook portfolio. This has escalated at a time when consumers are seeking preservative-free options,” an executive aware of the developments told ET.

“The negotiations on valuations, however, are being based on increasing hyper-local competitors and whether iD Fresh has the ability to scale nationally while sustaining its core business model of daily fresh supplies,” the person added.

iD Fresh Food differentiates itself from other branded breakfast batter makers, such as MTR Foods and Gits, by delivering fresh and un-stored batter fermented daily, leading to retailers placing orders daily instead of the usual fortnightly or monthly cycles.

A majority of the firm’s sales are done on quick-commerce and ecommerce channels. Its portfolio has expanded to parathas, paneer, curd and coffee now.

iD Fresh Food reported its first profits in the year ended March 2024, at ₹1.8 crore on a revenue of ₹563 crore. It has previously spoken of its ambition to expand presence in countries with a large Indian diaspora such as Singapore, the US, UK and West Asia.

DEALS PICK UP

Investment banker Equirus Capital in a report released on Thursday said the country’s consumer space saw 115 M&A deals in the January-September 2025 period, the highest in four years. The number is already higher than 100 deals reported in the whole of calendar 2022.

“Food and beverages, followed by apparel and accessories, witnessed the highest percentage of deals in Jan-Sept '25,” the report said.

In value terms, the consumer segment saw deals worth more than ₹21,200 crore in the first nine months, with 74% of the deals in the food and beverages segment, it said.

IMARC Group estimates the Indian packaged food market to clock sales of $224.8 billion by 2033, growing at a CAGR of 6.5% between 2025 and 2033. According to the research firm, the market reported total sales of $121.3 billion in 2024. It attributed the growth to rapid urbanisation, changing lifestyles, increasing disposable incomes, rising demand for convenience foods, and consumer preferences for ready-to-eat meals, in addition to growth in online food delivery.

You may also like

Govt trying to protect illegal voters: BJP's Tarun Chugh attacks Bengal CM over SIR claims

Hair Care Tips: A panacea for hair fall! Mix this with coconut oil and you'll see amazing results

Jairam Ramesh attacks PM Modi's 'selective diplomacy' as Trump's boasts pile up to 50

PM Modi calls for making conversations on mental health more mainstream

Moment out-of-control van smashes into cars parked in layby caught on camera