Concluding its year-long journey, Ather Energy is all set to list on Indian bourses today. The EV juggernaut’s IPO comprises a and an OFS component of up to 1.1 Cr shares.

Ather’s Risky Bet: Despite deferring its IPO due to ongoing market volatility, tariff wars, and Indo-Pak tensions, the EV maker decided to forge ahead. As expected, , closing with an oversubscription of 1.43X. For context, this was nearly a third of rival Ola Electric’s 4.27X subscription last year.

Returns Galore: The EV giant’s two cofounders – , while investors IIT Madras and Tiger Global are eyeing gains worth 40X and 8.3X, respectively.

Caution Ahead? While industry experts when it comes to locking horns with legacy players on its turf, factors like its over-dependence on external vendors for many components and subpar utilisation of its capacity are a few red flags. In addition, retail investors’ experience with rival Ola Electric’s stock could keep investors at bay.

Brokerage firms, too, have advised exercising caution due to valuation concerns and losses. While revenue from operations grew 28% YoY to INR 1,578.9 Cr in the first three quarters of FY25, .

With the IPO done, it is now Ather versus the markets. Can it pass the

From The Editor’s Desk: The Blume Ventures-backed healthtech platform had to shut its operations after the CDSCO said that imports of refurbished medical devices were prohibited in the country. The startup raised $3.4 Mn in January and will now return the capital to its investors.

: The ecommerce SaaS company reported a 17% YoY uptick in its consolidated net profit to INR 3.4 Cr for Q4 FY25. The metric, however, declined 46% sequentially. Operating revenue zoomed to INR 45.3 Cr from INR 26.5 Cr a year ago.

: The small finance bank’s revenue from operations jumped 123% YoY to INR 977 Cr in Q4 FY25. Net profit increased 83%, reaching INR 264 Cr compared to INR 144 Cr a fiscal ago.

Four years after foraying into India, Europe’s biggest neobank is finally making some headway and is set to launch its first batch of products in October. What aces does Revolut have up its sleeves to take on the well-entrenched fintech incumbents?

: Founder Bhavish Aggarwal plans to transfer the IP rights of the Ola brand to his family office. The proposed move has irked the shareholders of parent ANI Technologies, who fear losing out on the royalty income.

Arkam Ventures, Titan Capital, Sparrow Capital and India Accelerator participated in the funding round. The Delhi NCR-based startup connects customers with authorised dealers and automotive manufacturers of trucks, buses and three-wheelers.

The telecom major has started deploying its own network products across its domestic 5G network to cut costs. With this, the Reliance-backed company aims to reduce its dependence on international vendors like Ericsson and Nokia.

Amid mounting tensions between India and Pakistan, security agencies are actively monitoring the Indian cyberspace. This follows a Pakistani hacker group claiming to have gained access to sensitive data of Indian defence personnel.

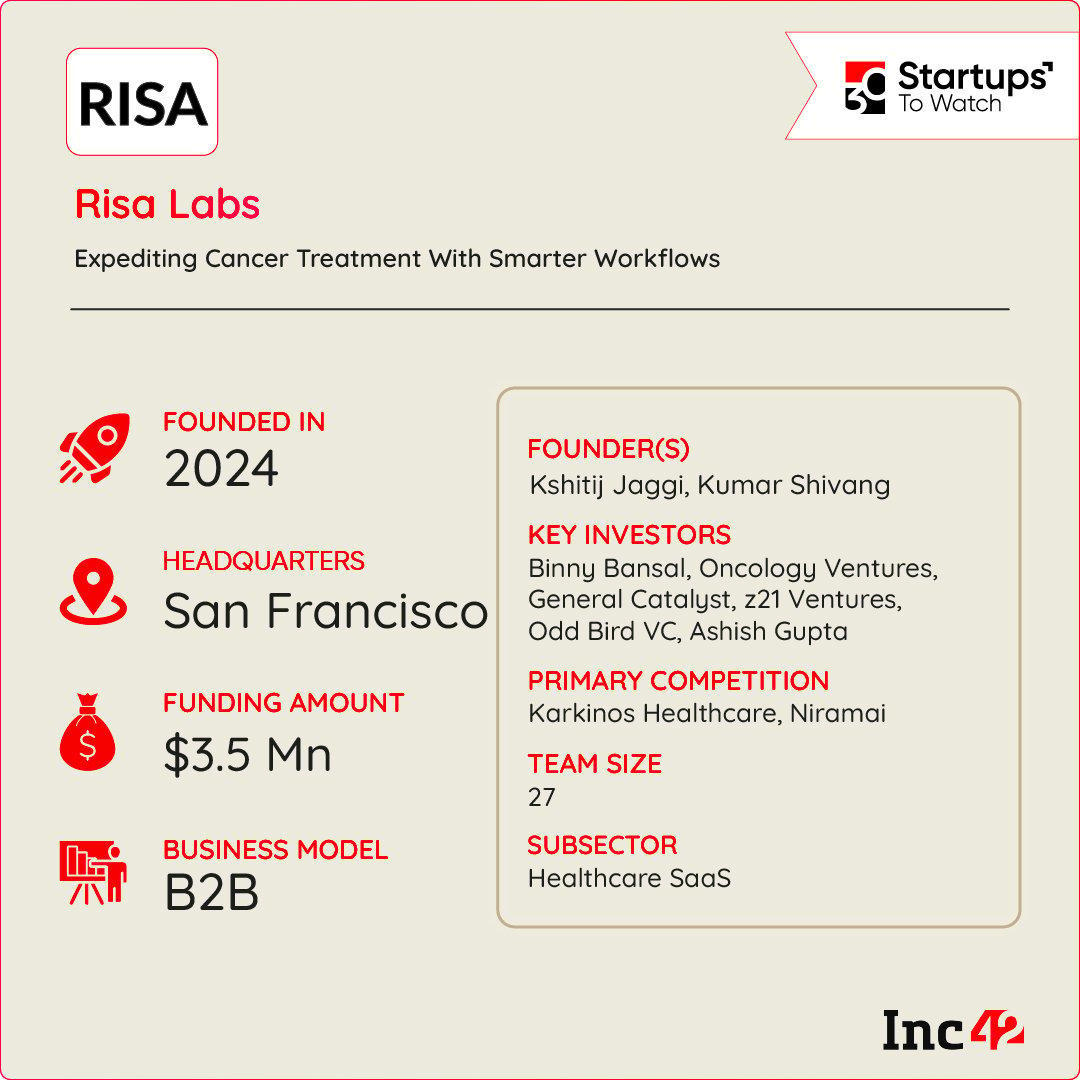

Inc42 Startup Spotlight How RISA Labs Is Expediting Cancer TreatmentA big pain point for Indian patients fighting the battle against cancer is the delay in starting their treatment. As per a report, 35% stage III and 33% of stage I cancer patients face delays due to manual and error-prone nature of administrative workflows in the hospital. That’s where RISA Labs steps in.

Founded in 2024 by Kshitij Jaggi and Kumar Shivang, RISA Labs’ AI agents help hospitals automate oncology workflows by breaking them into smaller tasks.

Culling Red Tape: The startup’s AI platform, BOSS, reduces the time taken for prior authorisation (seeking approval for insurance plans) from 30 minutes to under five by reducing manual workflows and administrative burden.

What’s On The Horizon? Going forward, RISA Labs plans to extend across multiple nodes within the oncology ecosystem, with an eye on its long-term vision of building a unified layer for AI-driven orchestration in oncology. Backed by Z47 and 3States, the SaaS startup aims to corner a big chunk of the $80 Bn global healthcare automation market.

But, with established players like Karkinos Healthcare and Niramai on its tail,

The post appeared first on .

You may also like

Punjab-Haryana water dispute: Supreme Court directs states to work with Centre to find 'amicable' resolution

Nationwide civil defence mock drill on May 7 following Pahalgam terror attack: All you need to know

Now, buying a house has become even easier. Bank of Baroda gave good news; 40 basis points cut on home loan

Samantha Ruth Prabhu seen crying at an event. The real reason will leave you emotional

Labour warns of more 'bumps in the road' on top of local elections disaster