Paytm’s Q4 FY25 results couldn’t have been more paradoxical. Despite being weighed down by a , the fintech giant has made a healthy stride towards its goal of turning profitable in Q1 FY26. Perplexed?

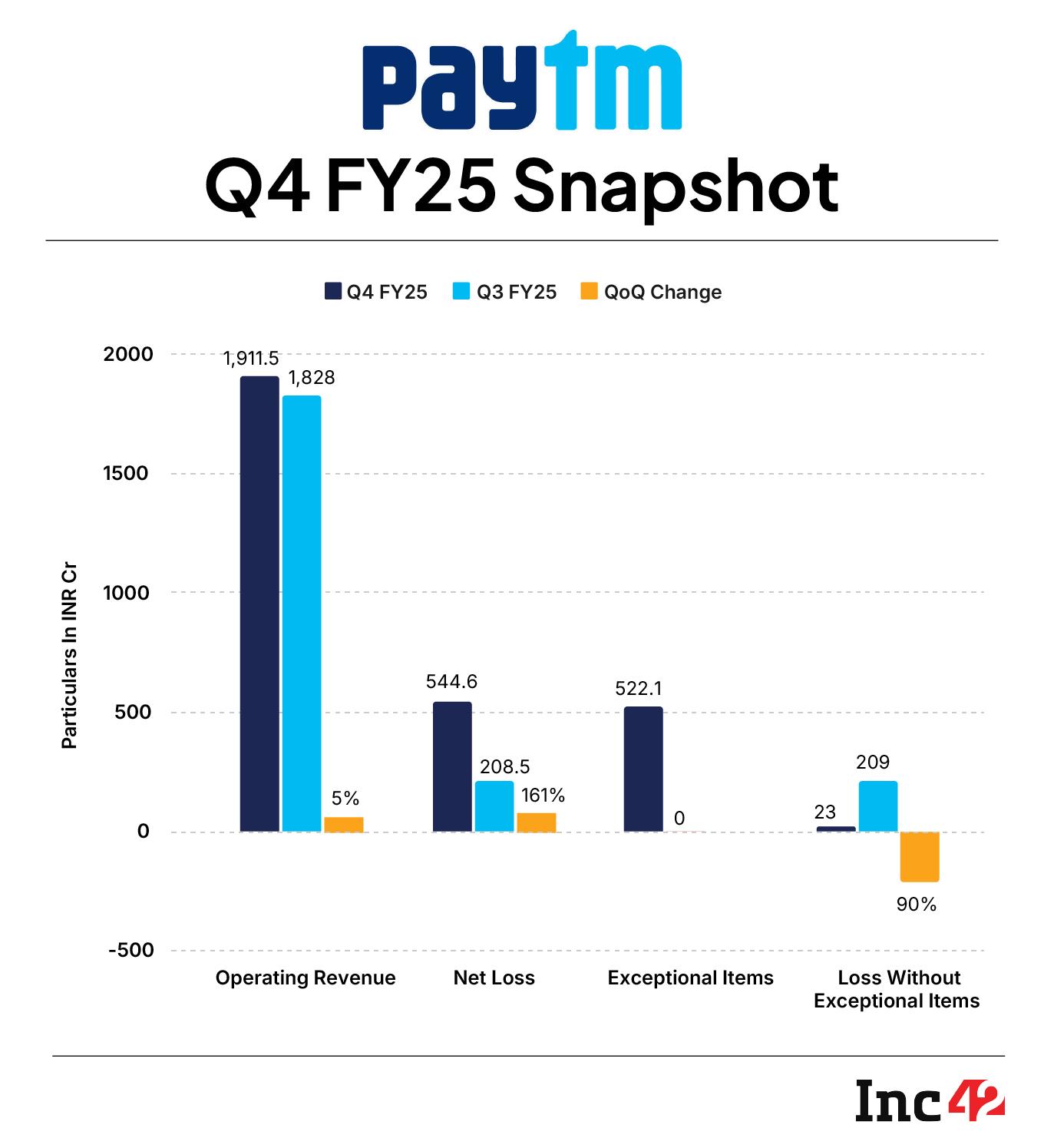

Well, if it were not for the exceptional loss of INR 522 Cr during the quarter, Paytm would have posted a loss before tax of INR 19.9 Cr, a giant leap from the INR 550.5 Cr loss incurred in the year-ago quarter.

However, eclipsing this silver lining is the company’s top line, which grew a mere 5% QoQ during the quarter (Q4) to INR 1,911.5 Cr and 31% YoY for the full FY25 to INR 6,900.4 Cr due to factors like and the company losing the Paytm Insider revenue stream to Zomato.

So, where does this leave Paytm, especially when founder and CEO Vijay Shekhar Sharma sees profitability around the corner in Q1 FY26?

Interestingly, the equation may have just become more complex for Paytm, as the current situation demands not just achieving profitability but sustaining revenue growth.

So, what ace does VSS hold up its sleeves? Speaking during the analyst call for Q4, Sharma gave a lowdown on the company’s FY26 strategy.

From Paytm moving back to its digital payments-first business model and its focus on the brand’s global expansion to slowing down its loan business, the company’s strategy is focussed on telling its stakeholders that its turnaround story rests on firm ground.

With that, let’s jump right into the contours of Paytm’s FY26 game plan.

Distancing From The Super App ObsessionPostponing its ambitions of becoming the WeChat or Alibaba of India, Paytm, one of the early adopters of the super app model in the Indian fintech sector, is now shifting course. The company is now planning to sharpen its focus on streamlining its user interface and re-establishing payments at the core of its strategy.

“We’ve been very crowded, cluttered for a long time,” Sharma said, referring to the array of services that Paytm has tried to bundle together in recent years to serve its super app dreams.

Not to mention, the decision is the result of Paytm’s arduous super app endeavour that was plagued with regulatory hurdles, razor-thin margins and resulted in , which once included the likes of Paytm Insider, Paytm Ecommerce, Paytm General Insurances, among others.

Taking customer feedback into account, the company is now looking to return to its “original vision” of becoming a payments-first app rather than marketing itself as a super app.

“Keeping the payments-led super app concept is better than calling super app first, payments second,” Sharma said. He added that the decluttering of its app has had little to no impact on the engagement.

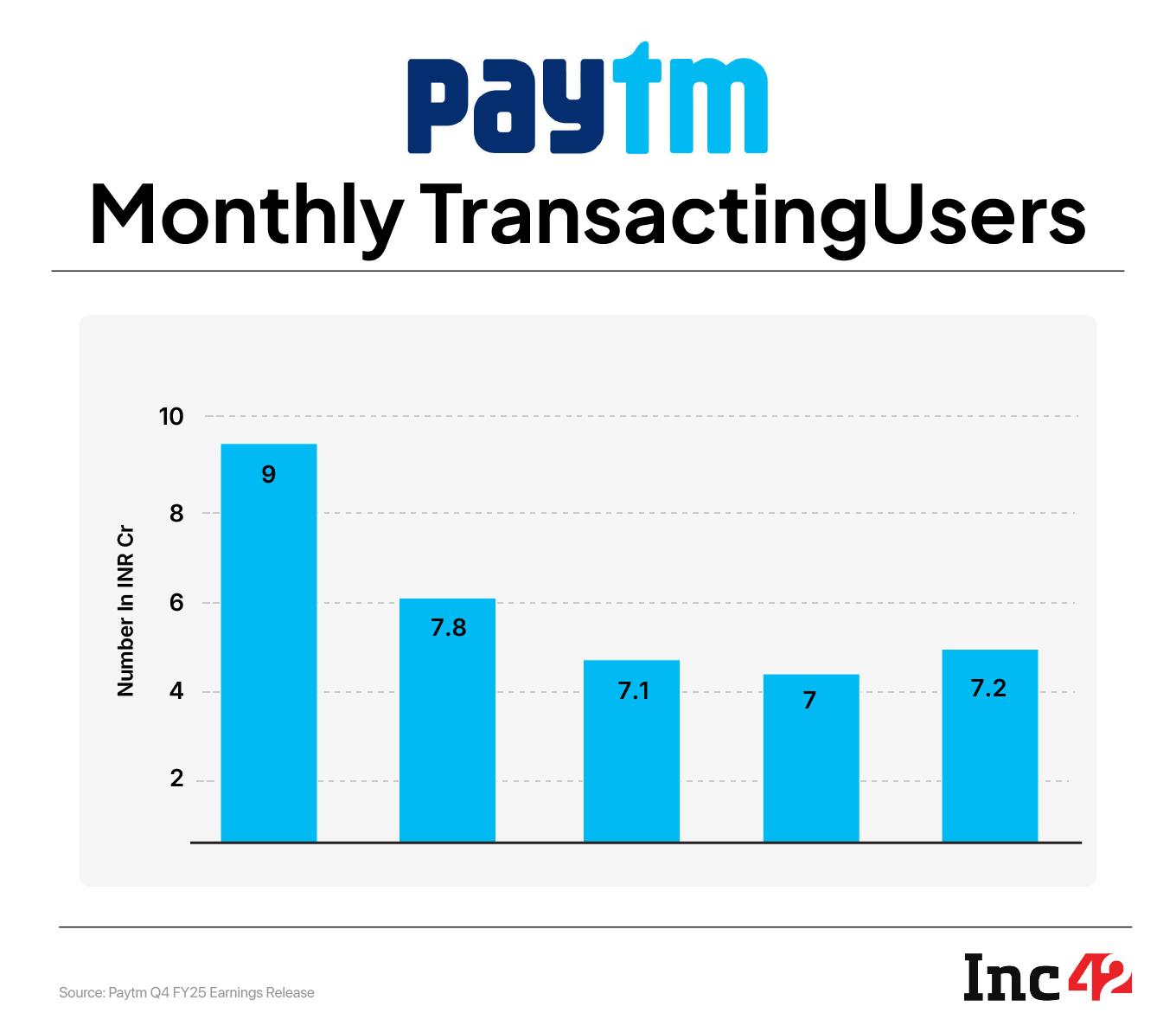

Paytm’s average monthly transacting users (MTU) on the app increased to 7.2 Cr in Q4 FY25 from 7 Cr in Q3 FY25.

A key enabler was onboarding new UPI customers following 2024. The approval paved the way for the company to reinitiate customer onboarding after the RBI’s restrictions on its payments bank effectively barred the company from onboarding any new UPI users on its platform.

Besides, CEO Sharma also spoke about the company’s digital wallet business, which after the RBI imposed restrictions on Paytm Payments Bank in 2024, citing compliance concerns and systemic risks.

Reclaiming Scale With Tech & Nuanced OfferingsAlthough the wallet has not been fully reintroduced, Sharma hinted at some progress. “We may be near a breakthrough… We have multiple options on the table,” he said.

Paytm’s decision to double down on payments emerges from the degrowth in its digital payments volumes. Even though Paytm is one of the early entrants in the UPI realm, it has not been able to dethrone market leaders PhonePe and Google Pay.

Although Paytm managed to retain its third position in the UPI market after being hit by the RBI’s regulatory whip last year, its from 14.1% in 2023.

Since last year, new players have expanded their footprint in the UPI verse. Take Navi and super.money for instance – the two companies have grown their transaction volumes manifold since 2024.

Now, with Navi and super.money growing their ambit, Paytm’s position in the UPI market is under pressure.

However, Sharma is optimistic about growing meaningfully, both in scale and profitability, without relying on aggressive marketing or user acquisition spending.

Instead, the company is doubling down on its product and technology as it sets its sights on a target user base of 200 to 250 Mn.

“I do believe that in India, there are about 200 Mn consumers that matter, and we definitely will aim for 200 to 250 Mn customers on our platform,” he said during the earnings call.

Highlighting how nuanced features such as the ability to hide transactions in the passbook with a swipe are quietly fuelling stronger user interaction, Sharma maintained that the company is focussing on the depth of engagement.

“These kinds of insightful features give us the capability to build more nuanced products,” he said, adding that the company would overspend on tech rather than marketing.

Imperative to mention that the company’s margin-conscious and product-first approach has started to bear fruit. Paytm’s Q4 payment services revenue grew 3.7% QoQ at INR 1,100 Cr (including INR 70 Cr in UPI incentives).

Viability Of Personal Loans In QuestionAfter dark clouds shrouded Paytm’s loans vertical due to a pause in onboarding new users following regulatory constraints, there has been a consistent decline in loan disbursals. The number of loans disbursed reduced to INR 1,422 Cr in Q4 FY25 from INR 1,746 Cr in the previous quarter.

Sharma acknowledged that Paytm’s consumer lending business was under pressure due to the regulatory quagmire, and user volume has yet to return to the pre-2023 level.

Yet, Sharma is optimistic. “Our future earnings and profitability are supported by users who’ve stayed,” he said.

Going forward, the company plans to reshape its personal loan vertical. It is in the process of shifting from distribution-plus-collections to a pure distribution model. “We are not going to aggressively pursue the distribution of the personal loans as the overall market is under stress,” he added.

Notably, the company has been scaling down its personal loan business for some time now.

In May 2024, it paused its , due to a decline in asset quality across the industry. At the end of Q4 FY24, Paytm’s personal loans distribution stood at INR 3,408 Cr versus .

On the contrary, the company has increased its focus on its merchant loans vertical. Paytm claimed that its merchant loan distribution business had grown from INR 1,386 Cr in FY22 to INR 13,958 Cr in FY25. In Q4 FY25, Paytm’s merchant loans grew to INR 4,315 Cr from INR 3,831 Cr in Q3 FY25 and INR 1,671 Cr in Q4 FY24.

Customer retention has played a key role in the growth of this credit offering. The company claims that 50% of its loans distributed in the fiscal year were to repeat borrowers.

Paytm’s International PlansAfter focussing on the domestic market for years, Paytm has already started laying the foundation for its international expansion. Paytm is establishing subsidiaries in the UAE, Saudi Arabia and Singapore markets through its Paytm Cloud Technologies.

The company is not focussed on B2C as part of its international expansion strategy. It is rather looking to export its technology stack through strategic partnerships,

“Internationalisation is not about launching the Paytm app in other markets. It’s about helping local players build their own solutions using our tech,” VSS said.

Reiterating that India remains the company’s core focus, the Paytm CEO said that its technology stack makes international partnerships an attractive and low-risk growth avenue.

As of now, Paytm’s Q4 FY25 results have investors intrigued as it stands on the brink of profitability. As a result, the company’s shares rallied more than 9% during the intraday trade on Wednesday, a day after the company announced its results. The Paytm stock closed Thursday’s trade at INR 834.30 on the BSE.

Meanwhile, JM Financial has given a ‘Buy’ rating to the Paytm stock. It has set a price target of INR 1,070, implying a 31% upside from Paytm’s closing price on May 6. Emkay Global has retained its ‘Buy’ rating on the stock with a price target of INR 1,050.

The post appeared first on .

You may also like

No requests for UN Security Council meeting

VE Day 80 concert has viewers in tears as Zoe Ball leads tributes to veterans

Army shoots down 2 Pakistani drones in J-K's Naushera: Sources

Presenter Zoe Ball's health battle that causes 'awful headaches' and 'jaw clenching'

VIDEO: Rajasthan CM Bhajanlal Sharma Monitors Border Situation Amid Escalating Tensions; Reviews Jaisalmer Drone Attack Reports